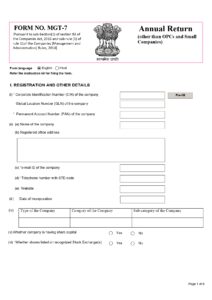

All About MGT-7

Every company has to mandatorily file annual return in prescribed e-form MGT-7(MGT-7A for one person company or small company) to ROC through MCA portal. MGT-7 must be filed within 60 days of the date of the Annual General Meeting. it shall include following::

- Registration and other detail

CIN, PAN, name of the company,

Register office address,

email id,

Telephone no.

Date of incorporation,

Type, category, sub category of the company,

Whether having share capital (yes/no),

Whether listed in recognized stock exchange(yes/no)

Financial year from/to,

Whether AGM held yes/no, if yes -date of AGM, due date of AGM,

Whether extension to AGM granted(yes/no)

2. PRINCIPAL BUSINESS ACTIVITIES OF THE COMPANY

3. PARTICULARS OF HOLDING, SUBSIDIARY AND ASSOCIATE COMPANIES

(INCLUDING JOINT VENTURES)

4. SHARE CAPITAL, DEBENTURES AND OTHER SECURITIES OF THE COMPANY

5. Details of shares/Debentures Transfers since closure date of last financial year (or in the case

of the first return at any time since the incorporation of the company)

6. Debentures (Outstanding as at the end of financial year)

7. Turnover and net worth of the company (as defined in the Companies Act, 2013

8. NUMBER OF PROMOTERS, MEMBERS, DEBENTURE HOLDERS

(Details, Promoters, Members (other than promoters), Debenture holders

9. DETAILS OF DIRECTORS AND KEY MANAGERIAL PERSONNEL

10. Number of Directors and Key managerial personnel (who is not director) as on the financial year end date

11. Particulars of change in director(s) and Key managerial personnel during the year

12. MEETINGS OF MEMBERS/CLASS OF MEMBERS/BOARD/COMMITTEES OF THE BOARD OF

DIRECTORS

13. BOARD MEETINGS DETAILS

14. REMUNERATION OF DIRECTORS AND KEY MANAGERIAL PERSONNEL

15. MATTERS RELATED TO CERTIFICATION OF COMPLIANCES AND DISCLOSURES

16. PENALTY AND PUNISHMENT – DETAILS THEREOF

17. Whether complete list of shareholders, debenture holders has been enclosed as an attachment /Yes No

Attachments

1. List of share holders, debenture holders

2. Approval letter for extension of AGM;

3. Copy of MGT-8;

4. Optional Attachments(s), if any

Fees for Filing MGT 7

Fee for filing (in case of a company not having a share capital) Rupees 200”

| Sl. No. | Share Capital | Fees (Rs) |

| 1 | Less than 1,00,000 | Rs. 200 |

| 2 | 1,00,000 to 4,99,999 | Rs. 300 |

| 3 | 5,00,000 to 24,99,999 | Rs. 400 |

| 4 | 25,00,000 to 99,99,999 | Rs. 500 |

| 5 | 1,00,00,000 or more | Rs. 600 |

| Period of Delays | Fees |

|---|---|

| Up to 30 days | 2 times of normal fees |

| More than 30 days and up to 60 days | 4 times of normal fees |

| More than 60 days and up to 90 days | 6 times of normal fees |

| More than 90 days and up to 180 days | 10 times of normal fees |

| More than 180 days and up to 270 days | 12 times of normal fees |

In case of delay in the filing of MGT 7 annual company return, a company is required to pay an additional fee as a penalty @ 100 per day.

Total views : 3876

Total views : 3876