Section 139 of companies Act, 2013 governs the provision regarding appointment of Auditors. As per section 139(6) First auditor is appointed within 30 days from the date of registration of company by the board of directors and subsequent auditor is appointed in annual general meeting.

Time limit for Filing of ADT-1

Form ADT-1 is to be filed with MCA when any company appoints first auditor/s or subsequent auditor/s. In the case of a newly incorporated company, the Form ADT-1 is to be filed within 15 days of the first board meeting and in case of subsequent auditor within 15 days of the Annual General Meeting.

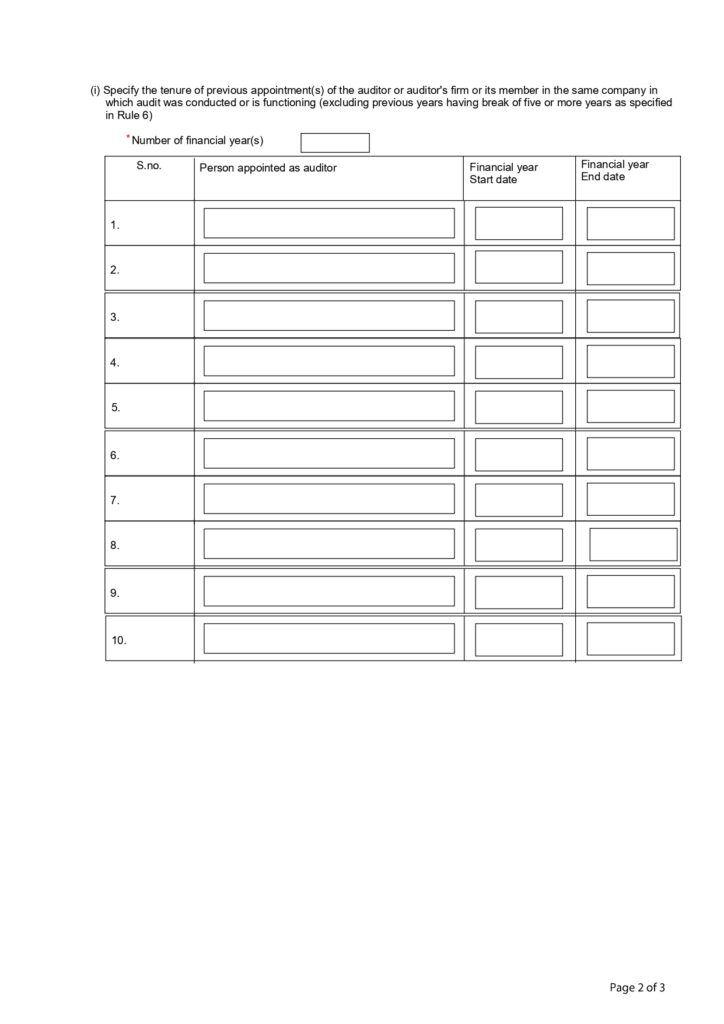

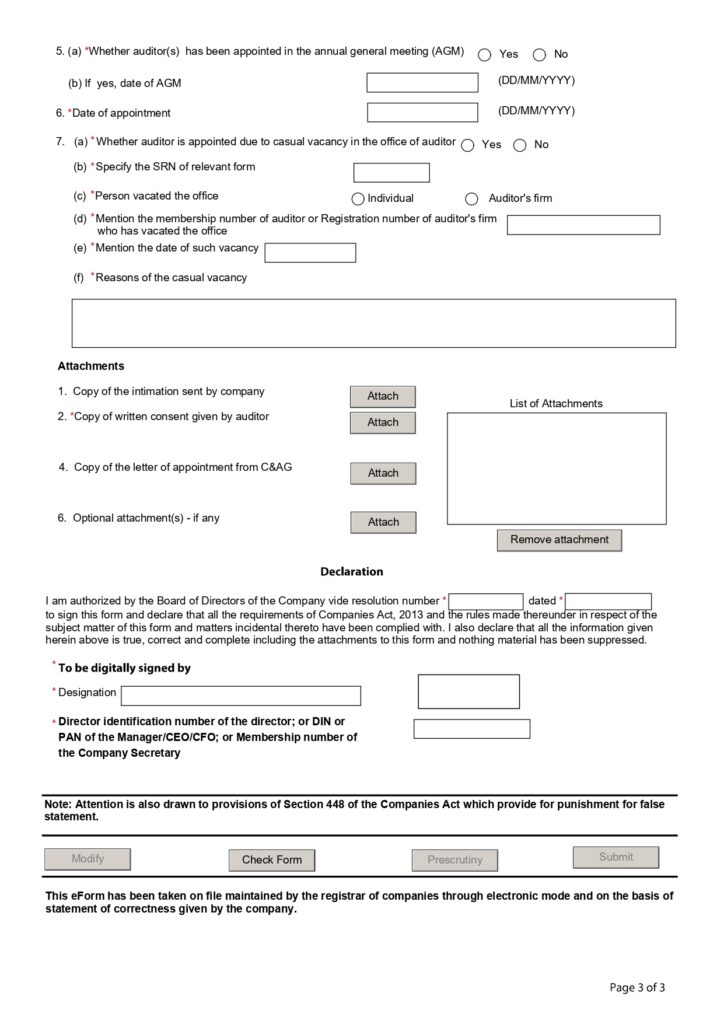

Document required: Following documents are required to be attached along with Form ADT-1:

- Copy of the Intimation sent by the company to the Auditor

- Consent letter of the Auditor

- Copy of board resolution copy or resolution passed in AGM

- A certificate from the Auditor stating that she or he or it is not disqualified or ineligible to serve as an Auditor under Section 141.

Steps to file ADT-1

- Download Form ADT-1from the MCA website.

- Fills Company’s Detail like name, address, Email id etc if you enter CIN and press pre fill then particulars of company will get auto filled.

- Fill Auditors detail, date of appointment etc

- Attach Copy of the Intimation sent by the company to the Auditor, Consent letter of the Auditor

- Verify using Digital signature

- Submit it through MCA portal

- Pay fees

- After payment of the fee, you will get the an acknowledgment to the registered email address.

Fess : it depends on the share capital of company. minimum fees is Rs. 200 and Maximum is Rs. 600.

ADT-1 Download Link https://www.mca.gov.in/MinistryV2/companyformsdownload.html

Total views : 3876

Total views : 3876