ROC (Registrar of Companies) forms are the prescribed forms that companies need to file with the ROC for various purposes, as per the provisions of the Companies Act, 2013. Here are some of the common ROC forms:

- Form INC-32: This is the form for incorporating a company with the Registrar of Companies. It is also known as the Simplified Proforma for Incorporating Company Electronically (SPICe). This form allows for the incorporation of a company with a single form, instead of filing separate forms for obtaining a DIN (Director Identification Number), name approval, and incorporation.

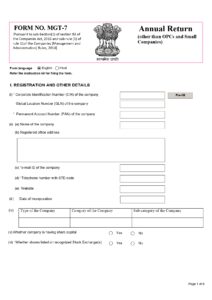

- Form MGT-7: This is the form for filing the Annual Return with the ROC. Every company needs to file its Annual Return in this form within 60 days from the date of the Annual General Meeting (AGM).

- Form AOC-4: This is the form for filing the financial statements with the ROC. Every company is required to file its financial statements, including the balance sheet, profit and loss statement, cash flow statement, and other relevant documents, with the ROC within 30 days from the date of the AGM.

- Form AOC-4 CFS: This is a form used for filing the Consolidated Financial Statements (CFS) of a company with the Registrar of Companies (ROC) under the Companies Act, 2013. The CFS provides a comprehensive view of the financial performance and position of a group of companies, where the company filing the form is the holding company or a subsidiary of a holding company. The AOC-4 CFS form is required to be filed by companies that have one or more subsidiaries or associate companies, and the holding company has prepared consolidated financial statements. The form contains information on the consolidated balance sheet, profit and loss account, cash flow statement, and other relevant details. The due date for filing AOC-4 CFS form is the same as the due date for filing AOC-4, which is within 30 days from the date of the Annual General Meeting (AGM) of the company.

- AOC-4 XBRL: This form is similar to AOC-4, but it is used for filing the financial statements of the company in XBRL format. Under the Companies Act, 2013, the following companies are required to file their financial statements in XBRL format with the Registrar of Companies (ROC):

- All listed companies in India and their Indian subsidiaries.

- All companies having a paid-up capital of Rs. 5 crores or above.

- All companies having a turnover of Rs. 100 crores or above.

- All companies that were required to file their financial statements for any financial year commencing on or after April 1, 2011, using XBRL mode.

- However, companies that have been struck off or have obtained dormant status are not required to file their financial statements in XBRL format.

- Form DIR-12: This is the form for filing changes in the particulars of directors of a company. Companies are required to file this form within 30 days from the date of any changes in the particulars of directors.

- ADT-1: This form is used for appointing an auditor for the company. It needs to be filed by the company within 15 days of the AGM.

- Form INC-22: This is the form for informing the ROC about changes in the registered office address of a company. Companies are required to file this form within 15 days from the date of any changes in the registered office address.

- Form INC-22A (ACTIVE): This form is used for filing the particulars of the company’s registered office, including photographs of the office premises, to ensure compliance with the provisions of the Companies Act, 2013.

- Form PAS-3: This is the form for filing the return of allotment of shares with the ROC. Companies are required to file this form within 30 days from the date of allotment of shares.

These are some of the common ROC forms. However, there are many other forms that companies may need to file with the ROC, depending on specific events or transactions. Companies should consult with their legal or financial advisors to determine the specific ROC forms they need to file for their business.

Related posts:

Pages: 1 2

Total views : 7800

Total views : 7800